One Year In: Lending Money to Complete Strangers via an API... And Why You Should Try It

About a year ago, I wrote a blog called "Show Me the Money: Six Strategies to Put Your Cash to Work," where I talked about two new(ish) investment strategies my wife and I were using. I wrote a followup blog about the first strategy, Electronically Traded Funds (ETFs), where I compared Betterment vs. Wealthfront. Now here is a followup on the second newish strategy that you're probably not yet trying out, but absolutely should be: Peer to Peer lending... or put another way: Lending money to complete strangers as an investment strategy.

I'm going to write this blog as a step-by-step how-to guide on trying P2P lending. Don't think you have enough money to become an investor? Wrong. Just set aside $25 to invest in each of the 2 biggest platforms. Seriously, who can't part with $50 to try something that will change your perspective on lending?

First, more on what P2P lending is:

- Historically, banks have been the institutions that take deposits from investors, and then loan money out to borrowers. Banks have shouldered the risk, and the FDIC has ensured investors against that risk. This is a very safe place to park your cash. But it also provides an absolutely dismal return. The national average yield on a savings or money market account is 0.47%. Want a higher return? Put your money in a 5 year CD and you'll make 2.25%.

- On the other side of the spectrum, borrowers pay interest through the nose. The current average credit card interest rate in the US is 15.91%.

- That's quite a spread! Banks are paying out a couple of percentage points to investors, yet they are charging borrowers (especially those using credit cards) very high rates, and garnering headlines like this one in the Wall Street Journal: "U.S. Bank Profits Near Record Levels."

- But technology -- and specifically the sharing economy -- is giving investors an opportunity to connect directly with borrowers, disintermediating the banks entirely. What if you had a little cash to lend out, and you could use a platform to find borrowers that fit the criteria you were comfortable with? This is what Peer to Peer lending is all about: Putting your dollars to work so others can borrow money. You make a higher rate than you would with a bank, and the borrower pays less than they would otherwise pay. In this scatterplot from LendingClub, you can see the median return for investors is 7.4%:

OK, what's the catch?

Just like anything in life, there's are risks to P2P lending. It's important that you really understand what they are. I'm going to walk through each risk that I consider significant, and how to protect yourself against that risk.

- The biggest risk is that your money is not FDIC insured. When you put money in a bank the first $250,000 of your deposits are protected by the US government. That's not the case when you put your money to work in the P2P economy. This means that if our economy tanks, the people you're lending to are more likely to default on their loans, which means more of the loans you hold will be charged off as uncollectible. To mitigate this risk, I recommend 2 things: Primarily, only put as much money into P2P platforms as you're willing to risk losing. That might just be $50. Or it might be $5k. Or $50k. Etc. Just treat this as a grand experiment where you might lose it all. But don't let yourself be so scared of this risk that you put $0 into P2P lending. The opportunity to leverage technology to disintermediate the entire banking industry is just too compelling to not give it a shot! I'd encourage you to put at least $50 into this so you can at least experience what it's like to put your dollars to work in the sharing economy. Secondarily, you can mitigate this risk by spreading your dollars out across many hundreds of loans. This diversifies your risk and makes it less likely that any one borrower defaulting will completely torpedo your portfolio.

- Your return is completely dependent on your risk tolerance. As you'll see below, if you only invest in "Grade A1" loans, your expected return will only be 3% ± 1.53%. That means it might be as low as 1.47% or as high as 4.53%. But at that point, you might as well put your money into a 5 year CD where it can return a safe 2.25%. So you have to be a bit more risk tolerant to really leverage the value provided by these lending platforms.

- These lending companies are startups, and startups have a bad habit of failing. LendingClub recently IPO'd, so it's a bit bigger than the second largest company in the space, Prosper. If one of these companies failed, it's hard to say what would happen to the underlying notes -- I'd assume they'd still be valid debt obligations, and likely picked up by some other company. But I'm sure it'd be messy. So that's a risk.

- The notes aren't liquid. A huge thank-you to Paul in the comments below for pointing this risk out -- it's a very important one: When you offer your money up to borrowers, it gets put to work for 36 to 60 month terms. That means you can't get your money back until the note matures. This is a problem if you'll need access to your invested funds for some unforeseen emergency or personal circumstance. For this reason, my wife and I think of P2P lending as "Hotel California" -- the money goes in, but it doesn't come out. What I mean is that we only invest money in P2P lending that we know we won't need immediate access to right away. There are some ways you can caveat this risk. There is a secondary market on LendingClub, so my guess is that if you really, really, really needed to get your money out, you could offer to sell your active notes to another investor at a discount. However, in my experience, the pricing on that secondary market will demand a steep discount on the face value of the note, meaning if you have $25 invested with Sally in our example above, and you need that $25 back, you might only be able to get $20 for that $25 note (I'm assuming a 20% discount on the note's face value but I don't really know what the secondary market will offer since I only tested it a bit -- I'd love to hear feedback in the comments on what the discounts tend to be for notes in various stages of maturity / status.) There's another caveat to this risk, too, but this one works in your favor: The entire idea behind getting a 10%+ return is that you won't ever need to touch the principal, because it's working for you. For example, let's say you invest $500,000 in LendingClub notes (that would be pretty aggressive! I'd love to hear from if someone who has put that much in). This would mean that while it's hard to get your $500,000 out in a personal emergency since it's deployed capital, what isn't hard is that you'd be making $50k annually in interest income (10% of the $500k). The median US household income was $52,250 in 2013, meaning you'd be earning as much for doing nothing each year as an average US household earns for working really hard. Of course, the super hard work is in amassing $500k that you can invest into a P2P lending platform in the first place! But you get the idea: Hard to get principal out, but potentially great investment income cash flow.

- Those are really all the risks I can think of. If you come up with some others, let me know in the comments below and I'll add them to the list.

Starting small: The ideal minimum investment size

OK so let's say you're like me and my wife -- you want to start small and see what it's like to put your dollars to work on a P2P platform. What's the minimum you should put to work? Like I said above, you can literally get started with $25 on each platform. So if you're debating between doing nothing vs. trying it, then literally just fund each account with $25, and fund two individual notes (the minimum investment size is $25 per note you fund). That's not the ideal minimum, however, and here's why: You want to diversify your risk across many borrowers, so if one defaults, it doesn't torpedo your returns. If you only invest $25 to fund one borrower, and that borrower defaults, then your return will be shot. There's a great article by LendingRobot that shows once you invest in at least 146 notes at $25 each (a total of $3,650), you have a statistically minuscule chance of earning a negative return. LendingMemo takes it a step further and breaks the diversification recommendations down by your risk tolerance -- they suggest funding a minimum of 200 to 300 loans (depending on the note's risk scoring grade level) at $25 each so you can get an expected positive return. 200 notes x $25 invested in each = $5,000. And there's another reason to start at a $5k investment level, as I'll describe below. So, to reiterate: Start with $50 just to experience it. But if you're really going to make this a part of our investment portfolio, invest at least $5k.

A side note about what "investing $25 in a note" really means: Let's say a borrower -- we'll call her Sally -- wants to borrow $10,000 to consolidate her credit card debt. She goes to LendingClub and applies for a loan. LendingClub will take that $10,000 loan and break it up into smaller chunks, and then offer each chunk to individual investors. So for example, Sally's $10,000 loan might be funded by 400 investors at $25 each. This diversifies the risk for everyone. If Sally defaults, those investors each only lose $25 -- a small part of their overall portfolio.

My wife and I use P2P lending for an aggressive part of our portfolio. Although we could choose to fund "A1" grade loans, we want to achieve a return of at least 10% annually, so we tend to fund D,E & F grade notes. In fact, as you can see in this screenshot below, LendingClub has over-allocated us on A,B & C grade notes, and can't fill our demand for the lower grade notes. This is typical because most investors who are putting money to work in P2P platforms want that higher return and are willing to accept the higher risk that comes with it.

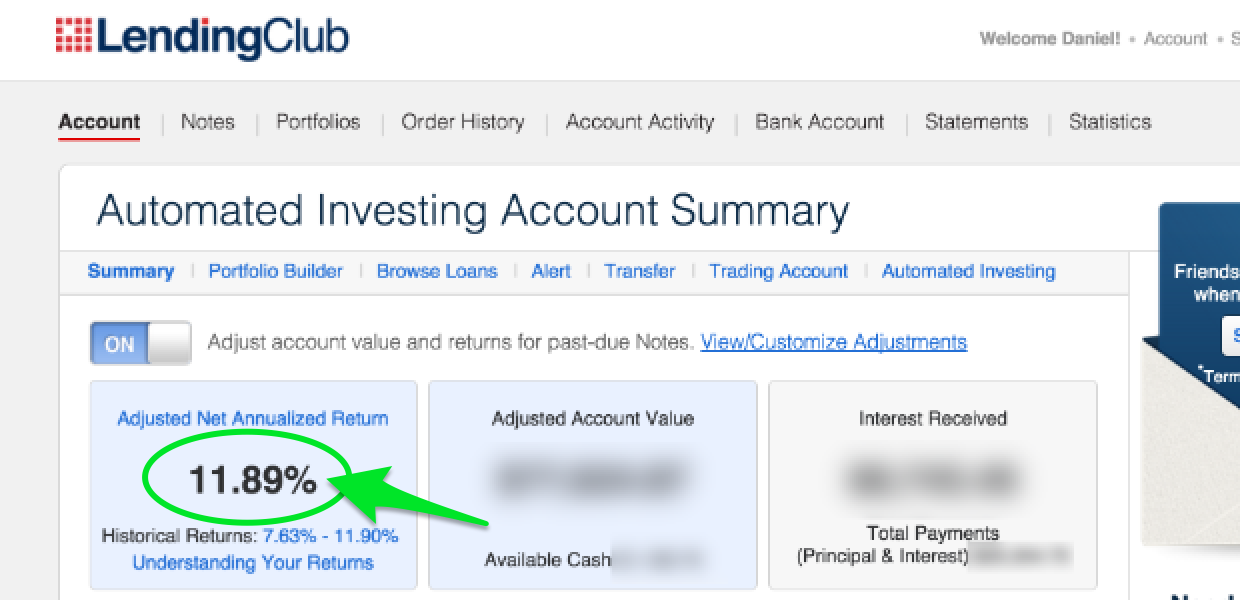

But even in this under-allocated state, we are achieving a net annualized return of 11.89% -- and that's after accounting for defaults & charge offs! Here's what I mean: By investing in lower grade notes, we are expecting that a higher percentage of those borrowers will default on their loans, and subsequently, have their loans charged off. But that's why the interest rate on these notes is higher -- to account for the expected charge offs. LendingClub has issued over $9 billion in loans since it started. You can see from this chart that the charge off rate on all loans is 3.6%. When you diversify your portfolio by spreading $25 investments over thousands of notes, you're able to control for the variables that would otherwise be really scary, like "what if someone defaults?!" At these large scales, it all becomes a math equation: How much risk are you willing to shoulder in exchange for what level of projected return net of that risk, and then set your investing criteria accordingly.

And just like a bank or a credit card, if a borrow goes late, the lending platform will try to collect on the loan. For example, below an actual default from our portfolio. This borrower got a $12,925 loan from LendingClub. We pitched in $25 to fund that note. They stopped paying, and for 3 months, LendingClub tried to collect. They eventually charged the loan off, which negatively affected the borrower's credit score. We lost our $25 -- but not without a fight! And LendingClub did all the actual "fighting". (You can see a larger version of the screenshot here.)

Another reason to invest at least $5,000 is that once you do, LendingClub will turn on a feature they call "Automated Investing." If you invest less than $5,000, you have to slog through each available individual note, deciding which to fund. When you put $5k into their platform, they'll handle all the investment decisions for you based on the criteria you set, so it literally becomes a "set it and forget it" experience.

OK that's it for the "P2P Investing 101" part -- I encourage you to give it a try. Start with just $50 to experience it. Give it a solid try with $5k. Or get adventurous if you have the cash: Putting $120k to work on the platform will earn you $1,000/mo in interest income at a 10% return. (Important tax note: This income is taxed at an ordinary income rate, not a long-term capital gains rate, which reduces your net return... talk to your tax advisor, because I am certainly certainly not one!)

But wait, there's more -- here's the best part if you want to go deeper:

For the past year, my wife and I have been using LendingClub's "automated investing" function and happily earning an 11.89% return. But it was driving me crazy that we were under allocated in the notes we most wanted to get into. So I did some digging. It appears that we're not the only ones that have this idea. Hedge funds and other institutional investors have been using an API access layer to snap up notes the second they hit the market -- indeed, faster than even LendingClub's automated investing can pick them up. I wanted in on the API action! So I turned to a service called LendingRobot which hooks into both LendingClub and Prosper through the API interface. I've just recently begun experimenting with it, but the interface looks awesome. For example, I created two "rules" which define how we want to invest our cash in LendingClub. For example, one of our roles is to only invest in notes with a 14%+ expected return, and to borrowers not in FL, AZ, CA or NV (here's why). LendingRobot projects we'll make a 15% ± 7.44% return with these filters.

The second rule is for borrowers who have a mortgage (no renters, no outright homeowners) with zero inquiries on their credit reports in the past 6 months (here's why) with a 12%+ expected return. LendingRobot projects we'll make a 13% ± 6.56% return with these filters.

The downside of using LendingRobot is that they charge a 0.45% fee for providing this lightning fast API access and filtering capabilities, which has the net effect of reducing our overall return by that amount. It's too early to say whether the value created LendingRobot will offset that additional fee, but I'm willing to give it a try. For now, I've kept "Automated Investing" turned on in LendingClub while at the same time letting LendingRobot have access to the cash in our LC account. I figure if their API really is faster, they'll get access to that cash first, and if it's not, they won't. I'll report back after a few months to let you know how the LendingRobot returns are comparing against the straight LendingClub returns -- and I'd LOVE to hear any feedback from anyone who has experience using LendingRobot or any of the other automated investing P2P services springing up out there.

I hope you give P2P lending a shot-- and welcome to the sharing economy! Please leave a comment below describing your experience if you do try it.

UPDATES:

I was having a convo over email w/ a buddy who's interested in this topic; he asked a few questions there that I'm re-posting and answering here so we can continue the convo w/ others who are also interested as well:

"have you seen many early repayments on your loans, and if that has impacted your returns?"

I just checked; it looks like 8.5% of the notes to date have been paid off early. LendingClub currently has my return at 9.96%, which includes those early pay-offs. LendingRobot, which as per above is more sophisticated, is projecting that the principal managed by LC will return 8.48%, and the principal now being managed by LendingRobot through the more sophisticated rules I've created will return 13.21%, a delta of 473 basis points, which is just insane. (As an aside, I have a hard time believing that LendingRobot's approach can really out-perform LendingClub's approach by that much, but as I mentioned earlier, I've started doing 100% of my allocations through the LendingRobot API as of a few months ago, so over time I'll be able to see if it bears out. If it does, it's incredible.) So yes, a large percentage of borrowers pre-pay notes, but I don't mind because that cash just gets put back into the bucket to be re-deployed, and since it's now being deployed by LendingRobot instead of LendingClub's algorithms, I prefer it that way since it should be re-deployed in more sophisticated ways.

"Also have you seen or used any of the secondary markets for these loans, e.g. https://www.lendingclub.com/foliofn/aboutTrading.action? May be a way to end your Hotel California scenario."

Yeah I've tried them; they suck. Basically, there's a huge discount applied on the secondary market. It's not worth the hit. For now I've just made an assumption that the cash is a one-way door, and the only return of cash I'll be seeing will come in the form of interest income, and return of principal when the loan matures in 3-5 years (should I choose not to re-invest it). And I'm OK with that. It's just something to plan for as a part of an asset allocation strategy.

"It also looks like there may be some tax implications of P2P lending. From my very brief reading, returns on this appear to be taxed as personal, not cap gains, income. That means if you made 10% off of stocks at a 15% capital gains rate (until Donald Trump gets his chance to change it), you would need to make closer to 15% on lending club at a 40% tax rate to match the tax adjusted returns."

Yes!!! As I wrote above "Important tax note: This income is taxed at an ordinary income rate, not a long-term capital gains rate, which reduces your net return... talk to your tax advisor, because I am certainly certainly not one!" And you're right; it makes equities much more competitive. But even if the returns were exactly the same, I still see them as vastly different instruments: P2P investing is a way to generate passive income while putting cash to work. The only way that I know of to do that with equities is to pick stocks that pay dividends, which is fine, but I'm in equities for long-term growth.

Interesting: I asked LendingClub if API-based services like LendingRobot got earlier access to notes than through LendingClub's own Automated Investing service, and the person who responded claims they don't:

"API users and users who access the Lending Club website by manually logging in to their account both have identical access to loan inventory and data; there is no preferential treatment or special access granted to investors who access the Lending Club platform using the API. To learn more about API, please click here for our FAQ's"

However, in the week or so that I've had LendingRobot on, it hasn't had a problem investing the cash in my LendingClub account, which makes me think it does have some sort of priority level access. Additionally, this LendingMemo blog also talks about the speed of API access (although i believe comparing it to a human -- not to Automated Investing):

"The quickest investors were actually using high-speed investing servers to auto-submit their orders. Their orders were being submitted over API commands that Lending Club had made available, which basically meant these people are investing through pure server code. No graphics. No Google Chrome. Just bare-bones lightning-fast ones and zeros picking up anything that matched their filters. No wonder I was losing."

So... it may be that the API makes everything available at the same time, but LendingRobot is just better at snapping notes up quickly. Unsure -- would love to know if anyone has any perspective!

Question From Simon:

Great post, Daniel. I'd be interested to read a followup to this after having used LendingRobot for a season or two.

Thanks Simon -- love and really appreciate all the amazing resources you've put on LendingMemo -- thank you thank you thank you! I'll definitely provide updates on LendingRobot as we use it.

OK Simon, I have an important update on a huge difference between LendingRobot and LendingClub:

LendingClub pegs our adjusted return at 11.89%. But LendingRobot estimates that return will only end up being 6.66%. Meanwhile, LendingRobot is estimating that the return they'll get from investing our funds into LendingClub using the LendingRobot rules I set up is nearly double, at 12.67%.

Hum. Something's definitely off.

I asked LendingRobot customer service and here's what Gilad from their customer support department said:

"Our expected return is different from Lending Club's Net Annualized Return in a number of ways: We do a real IRR calculation on your entire portfolio; Lending Club uses the NAR, which is fairly non-standard; and they assume that all loans that are current will not default, which is unrealistic - we use the probability of default based on our statistical model, and adjust it over time based on the survival curve we calculated for historical loans (so if a loan starts off with 7% chance of default, as time goes by the chance of default decreases; if it has 2 remaining payments it's close to 0). You should therefore expect our expected return to differ from Lending Club's NAR."

So it sounds like LendingRobot is using a much more sophisticated (and possibly conservative) approach to calculating a return.

I also pinged the CEO of LendingRobot to confirm they are using the same formula to calculate both returns, and he said they are.

I'm going to be super interested to watch this closely. If LendingRobot truly can deliver almost a 2x return to just using LendingClub's automated investing service directly (something I find hard to believe is possible) then it's totally worth using LendingRobot for all our investment decisioning.

For now I'm going to keep LendingClub's Automated Investing turned on, as well as have LendingRobot turned on, meaning they'll both have access to our cash balance on the LendingClub platform, and either of them can use that cash to buy available notes based on the note grade criteria we've set on LendingClub, and the rules we've set on LendingRobot.

If anyone else has any comments or feedback on how good (or bad) LendingClub's or LendingRobot's return calculator is, I'd love to hear about it.

I didn't get a very straight reply from LendingClub on this, but here's what they said:

"With regards to your 11.89% return, please be advised that while it is impossible to predict the performance of any particular portfolio, there are many factors that can influence returns, including the number of Notes in your portfolio that correspond to different borrower loans, the concentration of your investment, the composition of your investment, and the performance of the loans corresponding to your Notes. Learn more about how returns typically change over time and the factors that can influence returns when you click here."

Here also is a great blog that highlights different P2P investment strategies: http://www.joejansen.co/blog/2014/8/23/lendingrobot-vs-nickel-steamroller-vs-lendingclub-automated-investing

Strategy "E" is very similar to the strategy I outlined above in the LendingRobot section:

Here's a great SeekingAlpha post that compares bonds to P2P loans: http://seekingalpha.com/article/1937421-bonds-vs-peer-lending-differences-in-risks